Bullion sector banks on B&R Initiative

Major trade initiatives such as the Belt and Road are opening up new vistas of cooperation for the Chinese bullion industry, especially in the countries and regions associated with the initiative, an industry official said.

China, with its advanced gold mining and refining technologies and talent advantage, can play a complementary role with the regions and countries associated with the Belt and Road Initiative, most of whom have substantial gold resources, said Song Xin, head of the China Gold Association.

"The nation has become a leader in the global gold industry in fields of gold production and consumption and product designs, processing and manufacturing capacities are well suited to meet the market potential in the region, creating massive cooperation opportunities for the future," he said.

According to the China Gold Association, Chinese companies have invested over $4 billion in overseas markets during the past few years, and accessed gold resources of more than 1,500 metric tons. Production of gold by Chinese companies in overseas destinations stood at 35 tons by the end of 2017, it said.

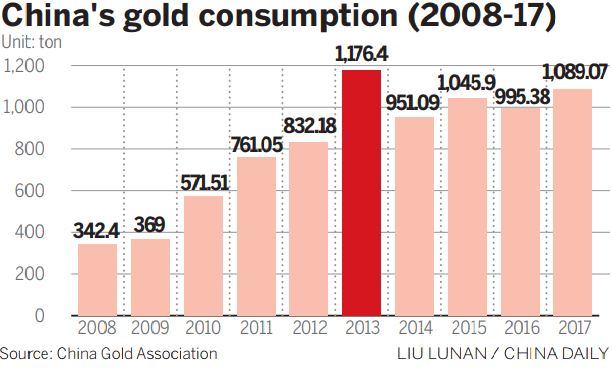

China's gold consumption reached 1,089.07 tons in 2017, a year-on-year increase of 9.41 percent, with demand for gold jewelry, gold bars and industrial uses surging. Demand for gold is expected to continue rising with the growth in high-end consumption and demand from second and third-tier cities, it said.

Considering the fact that Chinese have long prized gold for its financial and symbolic value, analysts believe that traditions and increasing prosperity will continue boosting demand for gold and hence further facilitate China's gold trade with regions and countries participating in the Belt and Road Initiative.

"The Belt and Road Initiative has played a positive role in facilitating Chinese gold miners' going overseas for gold assets, to meet domestic demand," said Zhu Yi, senior analyst of metals and mining from Bloomberg Intelligence.

"Gold producers such as Zijin Mining Group, China's largest gold producer, have been investing overseas to secure stable supply of raw materials," she said.

Zijin bought gold assets from Barrick Gold and Ivanhoe Mines in 2015. It also purchased Norton Gold Fields in Australia, to secure supplies.

"China is a resource-rich country, but the ore grade is relatively low and some resources are not easily accessible."

China imported more than 854,150 tons of raw materials in 2017 worth more than $1.69 billion. About 19 of the 55 regions and countries that China purchased precious metal ore and ore concentrate from are participating the B&R Initiative, it said.

China also imported 408,700 tons of gold material from regions and countries participating in the B&R Initiative in 2017, 47.85 percent of the country's total imports. All those assets are worth $573.4 million, 33.93 percent of the total value of imports.

Figures from the China Gold Association reveal that China has become the world's top gold producer for the 11th consecutive year since it surpassed South Africa in 2007.