Biggest financial risks tackled to ensure recovery

China will step up efforts to address major financial risks to ensure a stable recovery as growth momentum softens amid rising economic challenges, experts said on Wednesday.

Their comments came after top policymakers in Beijing stressed at a key meeting on Tuesday that more efforts are needed to tackle financial risks, as economic stability is crucial for the country's high-quality development.

President Xi Jinping called for efforts to coordinate the forestalling of major financial risks and ensure the country's financial stability based on market-oriented and law-based principles.

Xi, also general secretary of the Communist Party of China Central Committee, made the remarks at the 10th meeting of the Central Committee for Financial and Economic Affairs, which he heads.

Participants at the meeting said efforts should be made to strike a balance between ensuring stable growth and preventing risks, consolidate the momentum of economic recovery, ensure high-quality economic development to defuse systemic financial risks and prevent secondary financial risks while addressing risks in other areas.

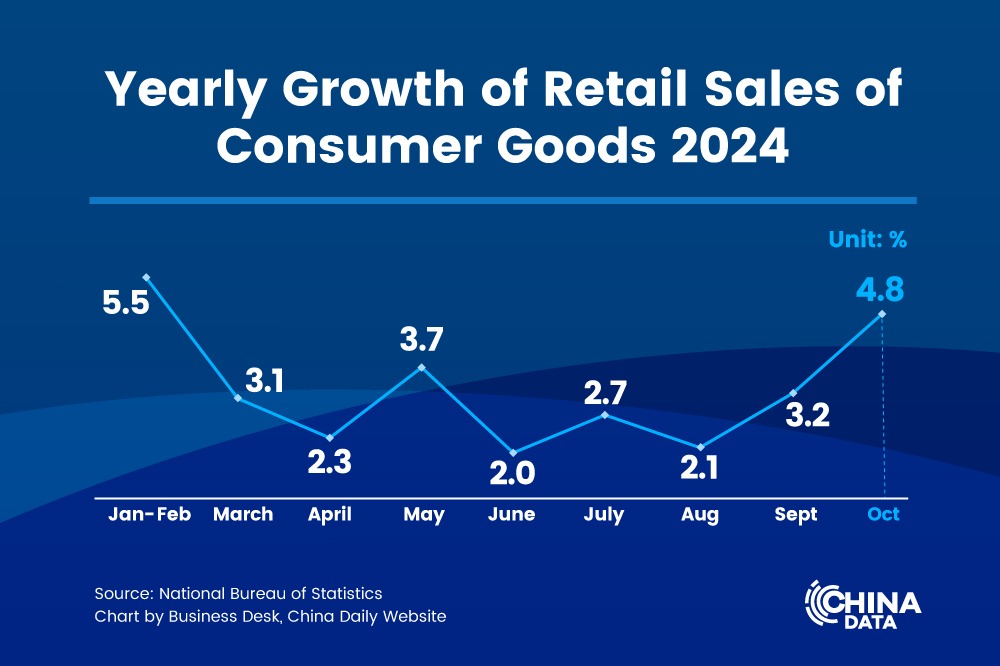

China's economic recovery is under increasing pressure amid a resurgence of COVID-19 cases. Economic data released by the National Bureau of Statistics on Monday showed that growth of industrial production and retail sales slowed significantly and missed market expectations in July.

Analysts said that the meeting sent a strong policy signal that the top leadership will take more action to contain financial risks that could threaten China's economic recovery and high-quality development if they are not addressed in a timely and proper way.

Potential risks such as rising bad loans in the banking sector, more corporate credit defaults, higher debt levels in the property market and worsening of some local governments' balance sheets will likely prompt more policy initiatives from the government, said Xu Hongcai, deputy director of the China Association of Policy Science's economic policy committee.

"Financial stability matters significantly for the Chinese economic recovery. Some risks have accumulated after the government adopted a slew of supportive measures, such as increased government spending and cheaper loans for smaller businesses, to rescue the economy from the damage caused by the COVID-19 pandemic," he said.

A report by the National Development and Reform Commission, submitted to the country's top legislature for review on Wednesday, said China's domestic demand remained weak and economic recovery is facing rising challenges.

The country needs to resolve balance sheet risks of local governments in an orderly way and step up its crackdown on illegal activities in the financial sector, the report said.

Wu Chaoming, chief economist at Chasing Securities, said that steady economic growth is crucial for China to maintain financial stability, and the country's macro policies are likely to strengthen support for the economy.

"The meeting has delivered a key policy signal that on the balance of stabilizing growth and preventing risks, the heft of stabilizing growth has outweighed the latter amid growing economic headwinds brought by the Delta variant," Wu said.