Global art sales shift online, NFT prices soar

Online momentum

The COVID-induced travel restrictions and social distancing forced art sales online. Global online sales of art and antiques in 2020 doubled the 2019 figures, accounting for a record 25 percent share of market value, according to the Art Basel and UBS Global Art Market report.

For Phillips, online sales in 2021 soared 417 percent above 2019 levels and by 68 percent over 2020 levels, with half of the lots being sold via live auctions. The pandemic has accelerated the process and will have far-reaching impact on the art market, with "more online activities happening", says Crockett.

But physical auctions won't go obsolete, because bidding online doesn't allow people to "read the room," notes Crockett, "where the dynamism, and bidder-bidder and bidder-auctioneer interactions are vital stimulants".

NFT dynamic

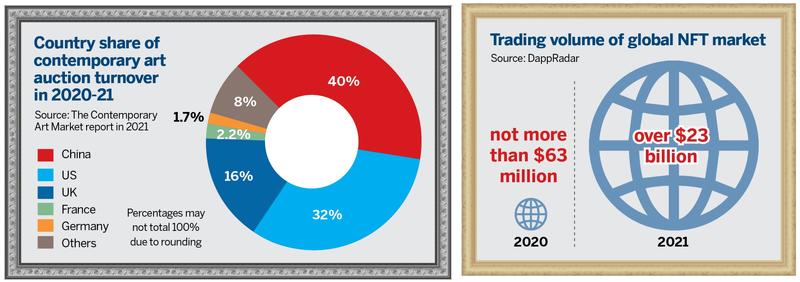

The NFT cult which began in 2014 as non-fungible tokens, fermented serious interest in recent years after over-the-roof prices for NFT artworks by artists like Beeple (Mike Winkelmann), Mad Dog Jones, and Kevin McCoy. NFT digital collectibles, such as drawings, images, videos, music, films, and games, use blockchain technology as authentication for a unique digital signature permanently attached to the work. That creates scarcity which fuels collector and investor momentum.

Christie's first ever NFT auction in Hong Kong last year helped the auction house shatter the $100 million ceiling in its NFT sales worldwide. "NFT has brought a new ecosystem of creators and collectors into fine art and collectibles. While it represents a different aesthetic and medium, NFT demands the same level of interest and commitment at the collecting level," says Drahi of Sotheby's Asia.

It unlocks a new world for creatives to play with artistic possibilities to compose NFT artworks, by transplanting digital content onto traditional artworks, or giving it a virtual reality or augmented reality twist, on metaverse, says Johnny Hon, founder of the Global Group of Companies. Metaverse is the next Web 3.0 evolution.

NFT is a proof of ownership that cannot be copied, and the rules for changing the ownership are embedded in the computer program, which ensures that "each time the NFT changes hands, the artist will have to get paid. The coin won't be released unless that condition is fulfilled," Hon says of the financial security that NFTs promise creators.

NFTs unlock a new venue for Hong Kong artists to increase their reach and visibility, reckons Chu. It's a boon particularly to homegrown budding artists to bypass galleries, and go directly to the public and collectors. Many local artists have made their first NFT foray, Chu says, and "in some cases, it's the most expensive piece these artists have ever sold".

Crockett says 90 percent of NFT collectors are new to Phillips and they are not only active in the NFT domain, but have started investing across categories. "It's no secret that some great 'Crypto Whales' are interested in NFTs," he says.

"Crypto Whales" are entities, individuals, or Exchanges, holding significant percentages of a cryptocurrency, to engineer a fall in value, or buying frenzy, by triggering the herd stampede of small investors. They thereby acquire massive additional holdings cheap, or lock-in significant profits. In the Bitcoin world, Whales typically hold 1,000 Bitcoins or more.

- Nanjing Massacre survivor dies, leaving only 31 registered survivors

- Guideline aims at improving elderly services

- Respiratory infections trend within expected range

- Quake-hit Dingri county residents provided with hot meals, clothing and shelter

- Students' arduous trek replaced by canyon cable car

- Top court urges tough stance on rural organized crime