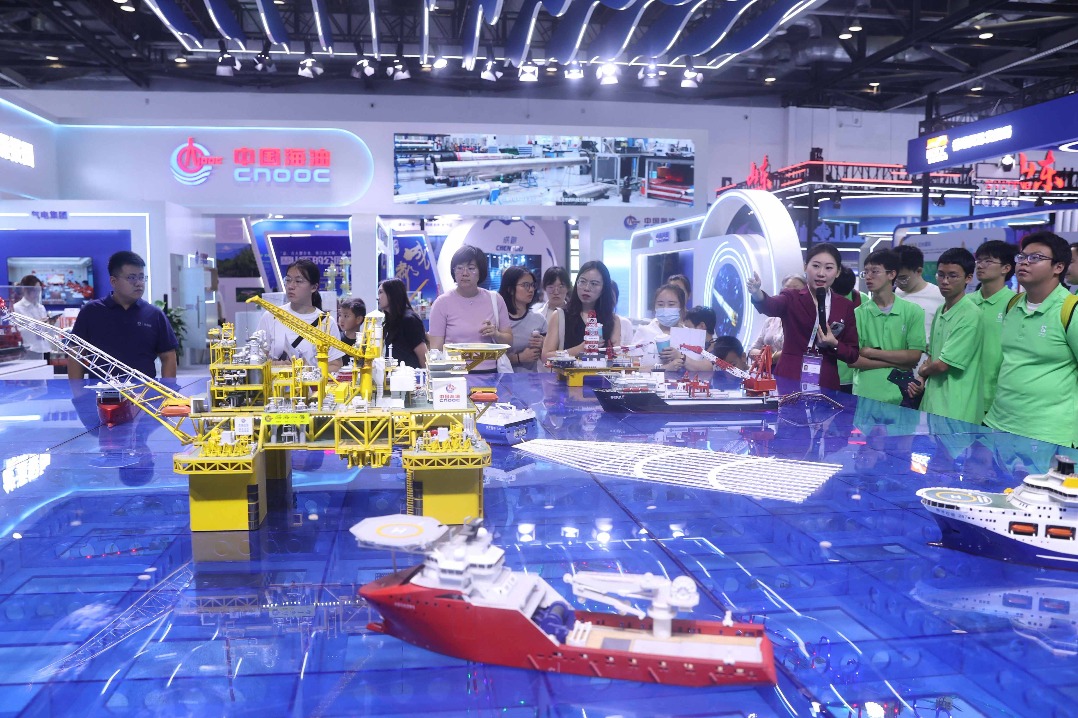

Regulators stress real estate financing

Forum links sector's health to stability, underlines key stakeholders' interests

China's financial regulators on Monday stressed the need for facilitating financing for the real estate sector to ensure economic stability.

They also assured the property market that more financial support would be in the pipeline to stabilize the sector.

"The real estate sector is related to many upstream and downstream industries, and its virtuous cycle is of significance to healthy economic development," said Yi Gang, governor of the People's Bank of China, the country's central bank.

Considering that there have been adjustments in the real estate sector, the PBOC has lowered mortgage rates and down payments to support basic homebuying and upgrade demand for housing, Yi said on Monday while addressing the Annual Conference of Financial Street Forum 2022.

In all, 200 billion yuan ($27.9 billion) worth of special loans were unveiled to support the delivery of sold housing projects while a structural policy tool was launched to encourage commercial banks to support the delivery, Yi said.

The program of "the second arrow" — a risk-sharing scheme to facilitate bond financing of private enterprises, including private real estate enterprises — was also expanded, he said.

Shortly before Yi's remark, the PBOC released a statement on Monday that called for efforts to maintain steady financing to the real estate sector, including loans to property developers, construction firms and individual homebuyers.

The country will support the reasonable extension of existing loans and trust loans relevant to real estate development and facilitate additional financing affiliated with the special loans to ensure housing project delivery, the statement said.

The statement was released after the PBOC and the China Banking and Insurance Regulatory Commission convened a meeting on Monday with heads of commercial banks.

Data from the National Bureau of Statistics showed that the country's real estate development investment shrank by 8.8 percent year-on-year during the first 10 months of the year, faster than an 8 percent decrease a month earlier.

"We should pay close attention to the difficulties and challenges facing the real estate sector," Yi Huiman, chairman of the China Securities Regulatory Commission, said at the forum on Monday.

The CSRC will support real estate enterprises' plans to improve their balance sheets, mergers and acquisitions in the real estate sector and equity financing of enterprises that have a certain size of real estate business, he said.

Pan Gongsheng, deputy governor of the PBOC, said the country will roll out short-term measures and improve long-term mechanisms to promote healthy and sustainable development of the real estate sector.

The country's over-five-year loan prime rate, a benchmark for mortgage rates, came in at 4.3 percent on Monday, the same as in October and down by 35 basis points since the beginning of the year.

As the country ramps up support to stabilize the real estate sector, some experts said the over-five-year LPR still has room to drop in the coming months, which will help shore up homebuying demand and further stabilize the real estate sector.

PBOC Governor Yi Gang said on Monday the carbon emissions reduction facility — a structural monetary tool that provides financial institutions with low-cost funding for their loans to key areas of carbon reduction — had supported financial institutions in issuing relevant loans worth more than 400 billion yuan as of the end of September.