Chief China economists speak on China's economic recovery

Editor's note: As the Chinese economic recovery accelerates, China Daily is talking with chief economists at international financial institutions to gauge their confidence in the Chinese economy and their forecast for its operation in 2023 and beyond.

Here is the latest interview with Xiong Yi, Deutsche Bank's chief China economist.

Q: With recent measures to address the property market downturn and boost confidence in the capital market and the private economy, what's your outlook for the Chinese economy for the rest of the year and 2024? Has the Chinese economy bottomed out and when may economic growth pick up?

A: We think the government will be able to achieve its 5 percent growth target for the year. We forecast growth will be 4.6 percent in the third quarter and will improve to 5 percent in the fourth quarter on the back of fiscal, monetary and property policy supports that have been recently announced. Recent high-frequency data on trade and prices are showing signs of stabilization; the acceleration of credit in August was also encouraging. A turnaround in the property sector in response to recent easing measures on mortgage lending and the lifting of restrictions in many first-tier and second-tier cities will be a decisive indicator for growth bottoming-out.

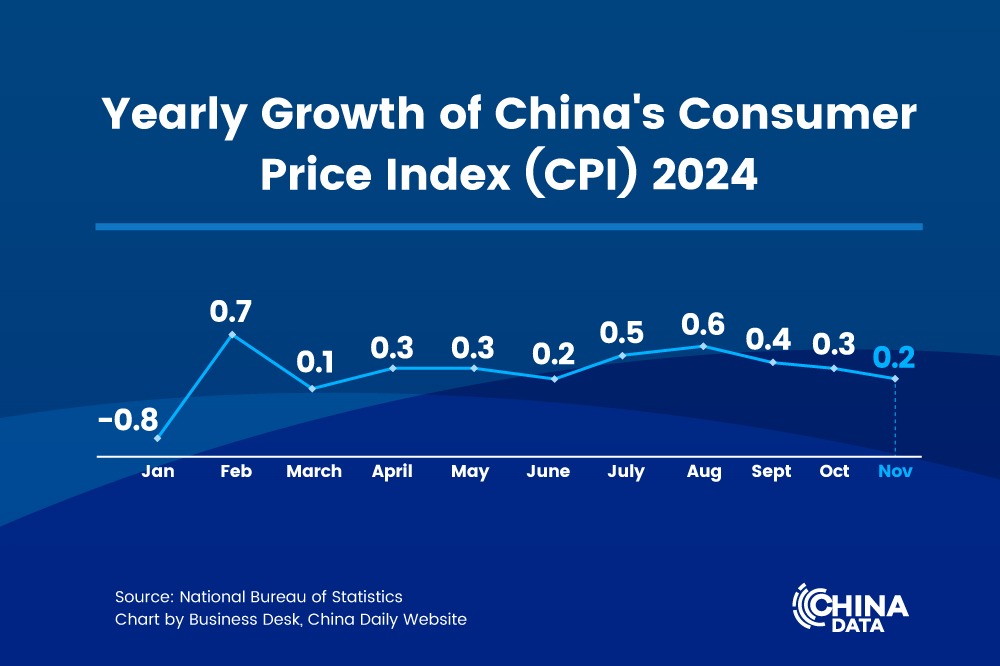

Q: Is China entering a period of deflation and what could be the consequences? How do you see the fundamental reasons for the challenge of insufficient demand in China's economy? What would be the appropriate policy responses that can address insufficient demand without aggravating structural problems, such as debt and asset price bubbles?

A: China is not in deflation yet – its core inflation is still positive, and headline inflation also turned positive again after one month of negative reading. Overcoming the low inflation problem will require material improvement in the labor market and acceleration in wage growth. These in turn will require both monetary easing and expansionary fiscal policy to boost aggregate demand. Although these policies could potentially lead to higher debt or fuel asset bubbles, they are still necessary.

Q: Do you think the recent preliminary signs of a property market recovery will evolve into a sustained trend? What's your projection of the property market's soft landing path going forward? How should the authorities solve the problem of property market downturn combined with local government debt pile-up without aggravating the problems in the long term?

A: Recent government policy measures have been encouraging. These, in our views, will have visible positive impact on property sales in first-tier and second-tier cities from many potential buyers, including new migrants as well as residents who want to trade up their homes. What remains to be seen, though, is whether these policy measures will be sufficient enough to lead to a sustained recovery in the property market. A sustained property sector recovery will be crucial for tackling local government debt financing issues.

Q: How fast do you think China will grow in the coming decade? What are the positive factors driving China's economic development? What policies are needed to bring the potential of such positive factors into full play?

A: We still expect China to maintain 4 percent to 5 percent annual growth in the coming years, underpinned by a sound performance of the manufacturing sector which continues to see productivity gains and has stayed competitive. To achieve moderate growth pace, or even potentially higher growth, China needs to provide sufficient countercyclical policy support to boost near-term domestic demand so as to avoid deflation and put an end to the property downturn. In the meantime, implementing business-friendly structural reforms may also help improve business confidence across the board. This will not only benefit the manufacturing sector but also the services sector that creates most of the jobs, which eventually will improve labor market conditions and bring higher wage growth.

Q: There are rising discussions of whether China is about to follow Japan's path of “the lost decades” because of the common challenges facing the two economies, such as an aging population, property market downturn and potential deflation risks. What's your take on this topic? What are the differences between the current Chinese economy and the Japanese one in the 1990s?

A: While there are some similarities, the biggest difference in our view is China has not had a sharp drop in asset prices and therefore households and corporate do not have a “damaged” balance sheet that needs to be repaired. What is driving conservative behavior among households and corporate are mostly a lack of confidence in future income and revenue growth. China's per-capita income level today is still much lower compared to Japan in the 1990s, which means it still has great potential to maintain moderate-to-high speed of growth if the government takes decisive actions, such as a combination of strong countercyclical support and growth-friendly structural reforms. These measures will help alleviate concerns and jump start economic growth in the post-COVID-19 era.