China continues?to drive global EV expansion

One car in three in the nation set to be?electric by 2030, IEA analysis predicts

Newly published figures in the International Energy Agency's annual Global Electric Vehicle (EV) Outlook show that in the first quarter of 2024, sales grew by around 25 percent compared to the same period last year, matching the same number sold in the whole of 2020.

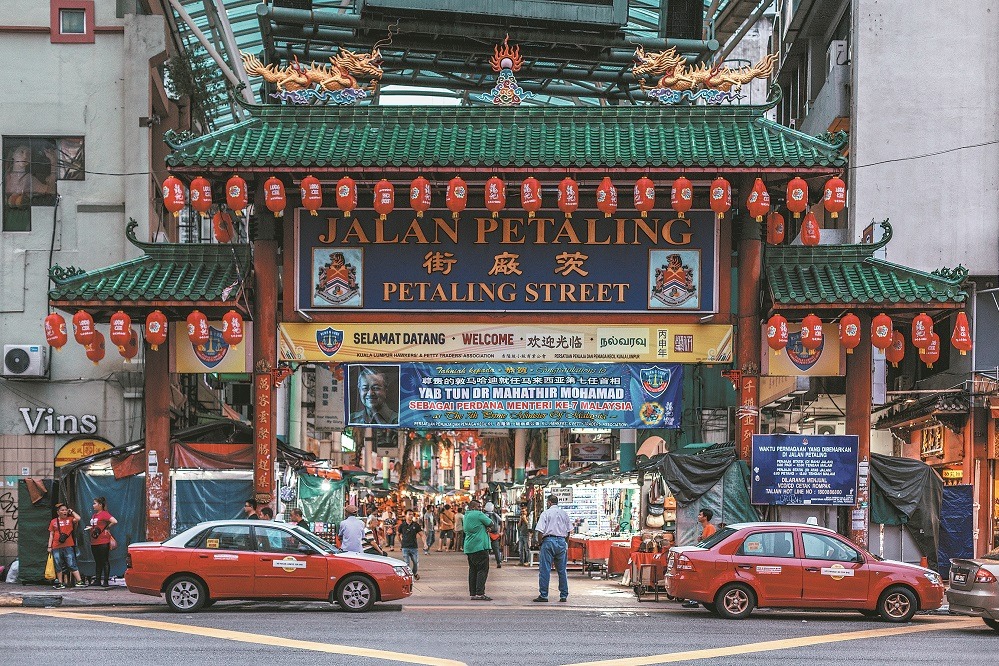

This comes after a record-breaking 2023, with EV sales totaling around 14 million worldwide. While traditionally strong markets such as China and the US have continued to perform well, emerging markets such as Thailand and Vietnam are also recording encouraging growth.

Based on current trends, it is estimated that by 2030, almost one in three cars in China will be electric, and one in five in both the US and the European Union, causing a significant fall in demand for petrol and a major reinvention of the automobile production industry.

Furthermore, if countries abide by their climate and energy pledges and meet them on time, by 2035, two out of every three new cars sold would be electric.

The reduced need for petrol across all forms of road transport would see daily demand for oil reduced by around 12 million barrels per day, which is close to the current daily combined demand from road users in China and Europe.

"The continued momentum behind electric cars is clear in our data, although it is stronger in some markets than others," said IEA Executive Director Fatih Birol.

"Rather than tapering off, the global EV revolution appears to be gearing up for a new phase of growth.

"The wave of investment in battery manufacturing suggests the EV supply chain is advancing to meet automakers' ambitious plans for expansion. As a result, the share of EVs on the roads is expected to continue to climb rapidly."

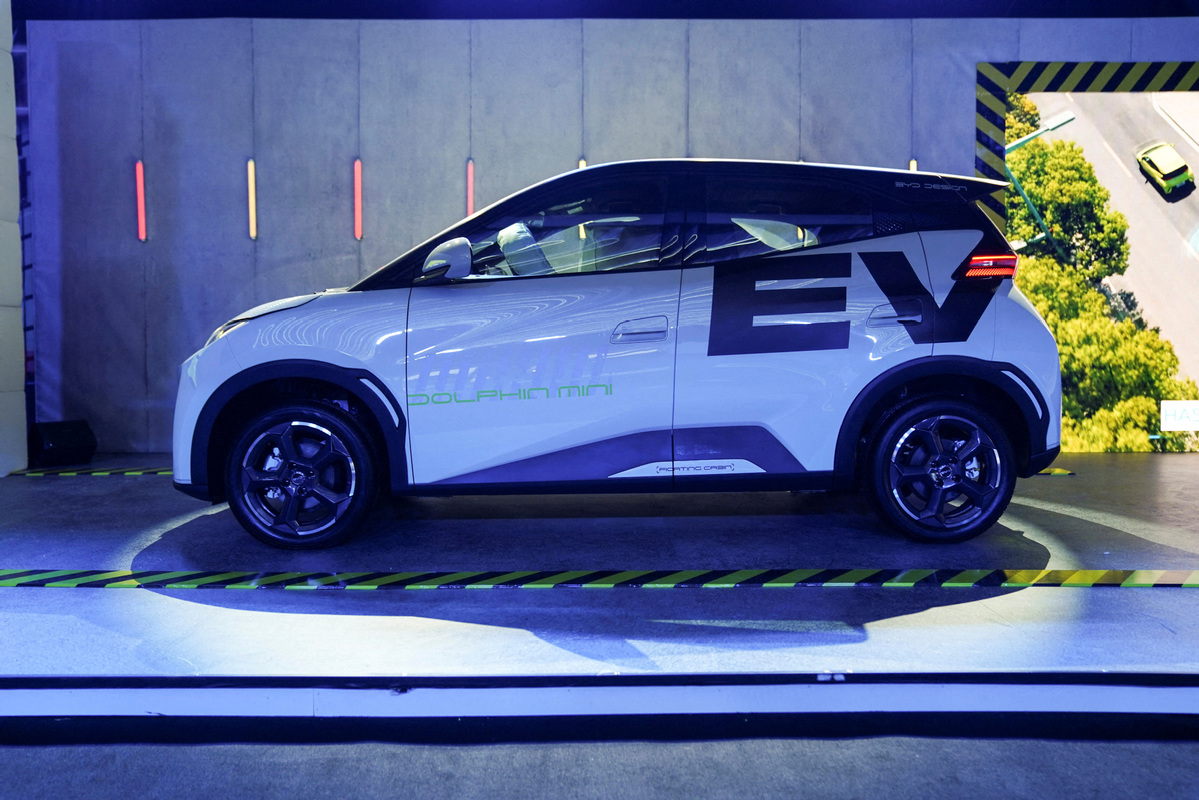

Although in markets such as Europe and the US petrol-driven vehicles tend to remain cheaper, the report noted that in China, over 60 percent of EVs sold in 2023 cost less than comparable petrol alternatives.

The increasing growth of Chinese EV exports, which accounted for more than half of all electric sales in 2023, combined with market competition and technical advances could help drive prices down, making the sector even more attractive for consumers.

Auto industry analyst Matthias Schmidt told the Guardian newspaper that the UK has emerged as Europe's biggest electric car market, and he expected it to stay ahead of Germany, where some manufacturers are consciously restraining sales until new CO2 emission rules are introduced in 2025.

"That delay will give (them) a small window to manipulate, because from 2025 the traditional manufacturers will really begin their electric vehicle push in earnest," he added.