Tariff hike fears send importers scrambling

Trump-Biden duties on China impact jobs and harm consumers, experts say

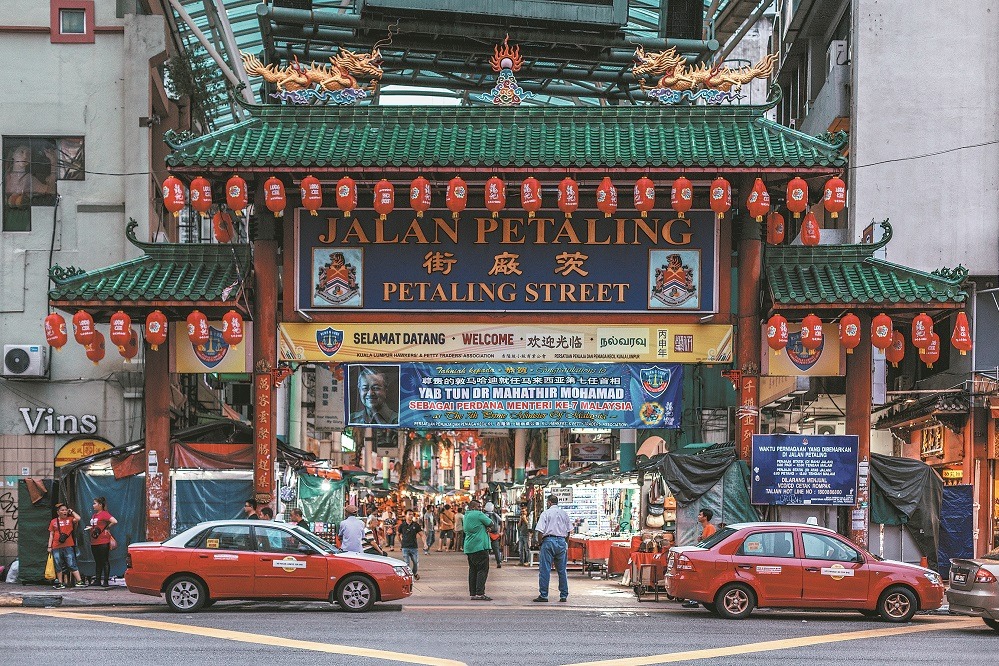

Footwear retailers and other importers in the United States may have to put on their running shoes in a rush to bring in goods before tariffs on China get raised again.

Republican presidential nominee Donald Trump, who kicked off the tariff spree on Chinese imports in 2018 when he was US president, earlier this year floated the idea of putting a 60 percent tariff on all imports from China and 10 percent on all imports worldwide.

"That (possibility) is obviously driving a lot of interest for our members about how to start to bring in products maybe prior to some of those decisions to push duties up," said Matt Priest, the president and CEO of the Footwear Distributors and Retailers of America.

He said it would "obviously impact costing and our consumers, who ultimately pay the price of those duties".

Priest made the comments at a Port of Los Angeles webinar on July 17 about monthly container traffic at the California port, where two-thirds of US shoe imports arrive.

Port of LA Executive Director Gene Seroka said that footwear traffic is a top 10 driver of import volume at the port "year after year".

More than 90 percent of the shoes sold in the US come from Asia — from China, Vietnam and Indonesia, Priest said.

The US footwear industry imports 2.5 billion pairs of shoes a year and already pays $4 billion a year in tariffs, according to footwearnews.com.

In 2019, Trump's second round of tariffs added a 15 percent duty on about half of the footwear imports from China. He cut the rate to 7.5 percent in 2020.

Priest said the industry has seen weaker purchasing power from people in households making under $100,000 a year, and they could face higher costs buying shoes in the back-to-school season.

"Footwear is kind of the barometer of the overall health of the economy because people need to buy shoes," he said.

In an interview with Fox News Sunday on Feb 4, Trump dismissed the notion of a "trade war" with China but said of the 60 percent tariff idea, "maybe it's going to be even more".

Trump imposed tariffs on an estimated $380 billion worth of Chinese goods in 2018 and 2019. The administration of US President Joe Biden has kept most of those levies in place, and in May, raised some others on an additional $18 billion in Chinese imports, such as electric vehicles and semiconductors.

In a July 18 speech at the Republican National Convention, Trump said he would welcome Chinese EV companies, if they built factories in the US.

"Those plants are going to be built in the United States, and our people are going to man those plants," he said, or he would impose tariffs as high as 200 percent on the cars entering the country.

Priest said there's been a "run on capacity to get product in" ahead of the start of the higher tariffs on electric vehicles on Aug 1, which has led to a spike in shipping container rates.

Gary Hufbauer, a nonresident senior fellow at the Peterson Institute for International Economics in Washington, told China Daily that higher tariffs could present a dilemma for the Federal Reserve, which has signaled it would eventually cut interest rates.

"More tariffs will certainly add to inflation and make the Fed's job harder. My guess is that the Trump and Biden tariffs added about one percentage point to the CPI (consumer price index) between 2018 and 2023, in other words about 0.2 percentage points annually for five years.

'High probability'

"If Trump is elected, I see a high probability that he will slap high tariffs on virtually all US imports from China," Hufbauer said. "Trump has talked about a 60 percent rate; my forecast is that he will at least go for 40 percent.

"China will retaliate. This will cause an enormous amount of trade diversion, both Chinese and US exports. It will also cause some outright trade destruction, maybe on the order of $200 billion annually," he said.

"That's bad news for the world economy. A few other countries will be tempted to increase their own tariffs or nontariff barriers, if only to dampen the effects of trade diversion. All told, this will shave something off world economic growth, perhaps 0.1 percent," he said.

In a June 26 article, Erica York, senior economist and research director with the nonprofit Tax Foundation's Center for Federal Tax Policy, wrote that the current Trump-Biden tariffs amount to an average annual tax increase on US households of $625.

York estimated that the current tariffs would lead to the loss of 142,000 full-time equivalent jobs.