Economy

Slowdown 'may add' uncertainty

By Wang XiaoTian and Xin Zhiming (China Daily)

Updated: 2010-07-16 09:16

|

Large Medium Small |

BEIJING: A slowdown in the country's economic growth in the second quarter may add more uncertainty to policymaking, but it will remain stable and new stimulus is unnecessary, Chinese economists have said.

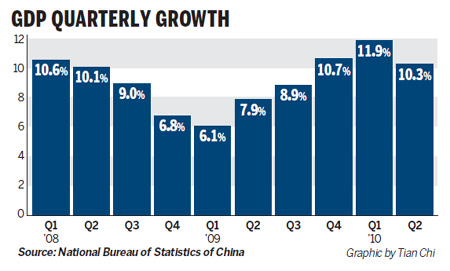

China's gross domestic product (GDP) expanded by an impressive 11.1 percent year-on-year in the first six months, the National Bureau of Statistics (NBS) said on Thursday, but its growth eased to 10.3 percent in the second quarter from 11.9 percent in the first.

Urban fixed-asset investment growth in the January-June period dropped slightly to 25.5 percent compared with the first five months.

"The data on GDP and industrial production confirms a slowdown, particularly in heavy industry, after the very rapid pace of expansion earlier in the year," said Louis Kuijs, economist of the World Bank China Office.

"This is in part because of the slowdown in investment led by the winding down of the massive stimulus initiated last year."

Dampened by an easing Chinese economy, international oil prices had fallen, coupled with the US Federal Reserve statement that the US growth outlook has "softened". Prices recovered later in the day after a falling dollar.

"The Chinese data was on the soft side in comparison to expectations and added to the negative mood brought about by yesterday's Fed minutes," said Eugen Weinberg, head of commodity research at Commerzbank AG in Frankfurt on Thursday.

China's economic slowdown is attributable to its tightening of the real estate sector and the control of credit as policymakers were worried about economic overheating early this year, analysts said. The weakening trend will continue, they said.

"The growth could slow to even 8 percent in the fourth quarter," said Wang Tao, head of China Economic Research at UBS Securities.

"It could be about 10 percent for the whole year", which is still well above the government target of 8 percent for GDP growth this year, she said.

The slowdown of the Chinese economy will also affect the economy of high-income countries, analysts said. "There would be some impact, but the performance of the Chinese economy remains good, which provides an anchor for other countries," said Zhang Monan, economist with the State Information Center.

The market has anticipated new stimulus measures from the government as economic growth slows, but economists said the possibility is slim although adjustments need to be made.

Dong Xian'an, chief macroeconomic analyst of Industrial Securities, said policies must now be targeted at stimulating domestic demand as the country restructures its economy.

"Domestic demand seems to have hit the trough," he said.

"We continue to see a policy-driven soft landing in China and believe policy flexibility will support growth if the slowdown turns out to be sharper than policymakers expect or target," said Barclays Capital in a research note.

The tightening policies could also be eased in the second half of this year, analysts said.

"Looking at the economy overall, the growth we expect for the year as a whole is still somewhat higher than the potential rate of growth, or the speed limit for the overall economy," Kuijs said.

"I think developments warrant continued consolidation of the macro stance after the massive stimulus last year and I do not think new stimulus is warranted."