The People's Bank of China became the 16th global central bank to ease monetary policies this year, after it reduced reserve requirements or the amount of cash banks must hold back from lending, starting from Thursday.

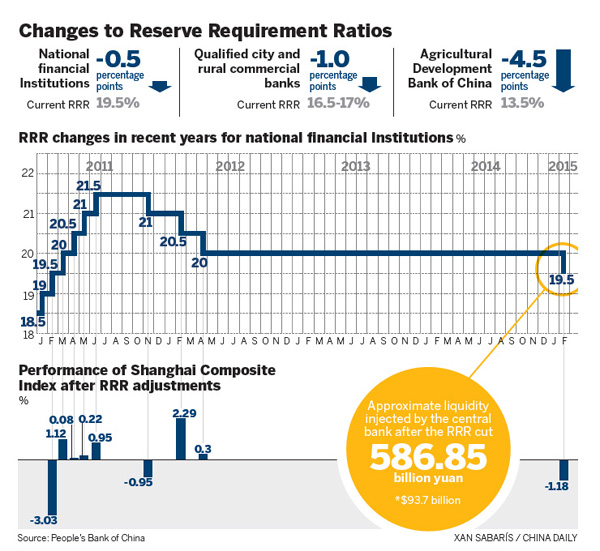

The PBOC said it will lower the RRR for all financial institutions by 50 basis points, making it the first broad cut since May 2012. Meanwhile, an additional targeted RRR cut will take effect for city and rural commercial banks with sufficient exposure to small and medium-sized enterprises. The RRR for the Agricultural Development Bank of China will be lowered by 450 basis points.

Though the RRR cut is more of a follow-up measure to the steps announced by other central banks, it also means that the Chinese currency is entering an era of depreciation, said Lu Zhengwei, chief economist at Industrial Bank Co Ltd.

Due to the global deflation pressure arising from falling crude oil prices, most of the global economies have come out with various monetary policies, but all with the same objective-to boost economic growth amid the slow recovery after the financial crisis.

Following the US Federal Reserve's announcement that it ended bond purchases or the quantitative easing policy in October, the market expects that it would hike the policy rate in the second half of this year.

On the contrary, the European Central Bank released its quantitative easing plan in January, after it cut the policy rate to below zero and introduced measures to increase liquidity.

Meanwhile, the Bank of Japan has decided to expand the size of its monetary stimulus plan.

A positive economic growth expectation in the US and the possibility of higher interest rates have lifted the dollar's value against the euro and yen.