The money and talent flow from West to East

Updated: 2010-01-28 07:27

(HK Edition)

|

|||||||||

During the past ten years, emerging markets like China's were the kings.

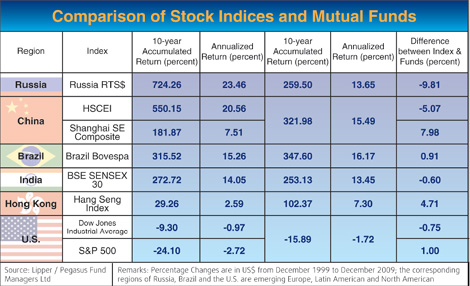

Russia's and China's major stock indices have risen by 724.26 percent and 550.15 percent respectively. In other words, the annualized returns exceed 20 percent. On the other hand, the US stock market recorded a decline, signaling that Western capital kept on flowing into the East.

In Chinese, we use "water" to describe "capital" or "money". Hence, we can say, "Water flows from West to East". A review of the history of this flow offers some insights into the past - and perhaps into the future.

Ten years ago, there were no Russia or Brazil single-country funds. Compared with the Russian RTS index, Emerging Europe funds on average underperformed 9.81 percent a year, whereas Latin America funds slightly outperformed the Brazilian market (see Table 1).

Financial crises broke out in emerging markets during the 1980s and 90s. The debt crisis in Latin America in the 80s, followed by the Mexican economic crisis, the Asian financial crisis and the Russian debt crisis in late 90s, drew investors' money back from the emerging markets to developed markets. That was actually an unbalanced money flow. In the past decade, money flowed back to emerging markets and the money distribution normalized.

So, how about the coming ten years? I think that, as the source of the 2008 global financial tsunami, the developed markets, such as the US and Europe, suffered substantial damage, so money will continue to flow into emerging markets.

This will be another unbalanced flow, pumping up another bubble. However, the emerging market asset bubble will not burst soon.

In the coming decade, the average yearly economic growth in developed countries will be around 2 percent, while that in emerging countries will lie between 5 percent and 10 percent. Since March 2009, there has been around US$22.65 billion flowing out of Europe and US mutual funds whereas around US$ 34.27 billion has been flowing into emerging market mutual funds. Besides BRIC (Brazil, Russia, India, China), other emerging countries, such as Indonesia and Vietnam, are among the top choices. Ten years ago, there were no SFC-authorized Russia or Brazil single-country funds. As BRIC began its ascent, many fund houses launched single-country funds. I believe that, in the coming ten years, more and more single-country funds and emerging market sector funds such as Asian or China domestic consumption funds, infrastructure funds, or technology funds will be launched. That is, regional funds will be singularized, and sector funds will be regionalized. Along with "Water flowing from West to East", the investment horizon will become deeper, wider and broader in the future.

Capital flows into emerging markets, and so does human capital. In the past, most talented professionals who studied overseas remained in foreign countries.

As foreign companies expand aggressively in China and hope to ride on its global growth engine, foreigners and expats are learning Putonghua so as to raise their competitiveness. Some returnees coming back to a prospering Shanghai may have to battle for jobs, or, instead, choose Hong Kong as an alternative or transit hub.

Underlying all of this is this dynamic: Capital, talents and investment opportunities complement each other. Investment opportunities attract capital, which attracts talents, and talents can create more new businesses and new technologies, or new investment opportunities. On the other hand, new businesses and new technologies train and cultivate talents, who earn money and then invest in different investment opportunities. This is the same as the relationship between chicken and egg.

Instead of becoming embroiled in regional competition for these talents, investment and markets, Hong Kong should think about how to economically merge with Guangdong province and Macao, instead of competing with Shanghai on its own.

In any event, please fasten your seat belt, keep your eye on these emerging markets in the next decade and enjoy the ride.

Paul Pong is the Managing Director and Founder of Pegasus Fund Managers Ltd.Opinions expressed in this article are entirely those of the contributing author.

(HK Edition 01/28/2010 page4)