STO Express plans backdoor listing

|

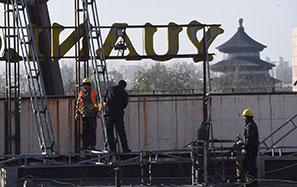

Workers sort deliveries at an office of STO Express Co Ltd in Fuyang, Anhui province. The company plans to become the country's first listed express delivery company through a reverse merger with a shell entity in Shenzhen, Guangdong province. Wang Biao / for China Daily |

Shanghai-based STO Express Co Ltd is set to become the nation's first listed express delivery company through a reverse merger with a shell entity, sources said.

After nearly two months of trading suspension, Shenzhen-listed IDC Fluid Control Co Ltd announced on Wednesday that it has reached an initial agreement with STO Express for a restructuring.

Reverse merger, also called backdoor listing, helps a private company float shares by injecting its assets into a publicly traded firm.

For IDC Fluid Control, a manufacturer of faucets, taps and bathroom accessories based in Zhejiang province, the deal is considered timely and urgent. Till date, it has received two warnings pertaining to insufficient assets from the lender it was pledged to by its actual owner Zheng Yonggang 10 months ago.

For STO Express, the listing is of vital importance in its competition with Shanghai YTO Express (Logistics) Co Ltd, a Shanghai-based express delivery firm, as both seek to be the first listed company in the sector.

In the same dated announcement, STO Express confirmed its plan to go public. "This move is a response to the market trend, and an effort to make the STO Express brand bigger and stronger. The firm set a goal of going public a few years ago," it said in an announcement.

The boom in e-commerce and consumers' changing perceptions about online shopping have driven the rapid growth of the domestic express delivery market. Despite a slowing economy, the express delivery industry has maintained a high growth rate.

The total amount of express delivery packages has soared 8.2 times over the past six years, and about 14 billion packages were delivered across China last year, a year-on-year growth of 52 percent, according to the State Post Bureau.

China's express delivery market is segmented with about 14,000 State-owned, private and multinational companies, among which, STO Express, YTO Express, ZTO Express Co Ltd, Shanghai Yunda Express Co Ltd, and SF Express (Group) Co are the top five players, but none of them is listed.

On Oct 14, the State Council approved a proposal to promote the development of domestic express delivery business, and urged companies to use capital forces to become bigger and stronger.

But due to the slump in the A-share market, the regulatory authorities have suspended approvals for new listings since July. As a result, getting listed through a shell company seems to be the only way out for STO Express.

Li Shiqing, an industry analyst from Minsheng Securities Co, said: "The capital market will speed up the process of upgrading management, expanding service network and lifting technology standards, all of which will help STO Express win more market share."

Likewise, YTO Express is also waiting opportunities to go public. Latest information shows it had received capital from Ali Capital. Founded in 1993, STO Express delivers one-sixth of the nation's total express delivery packages. Its close competitor YTO Express has about 21 percent of the market share, according to its Chairman Yu Weijiao.

wang_ying@chinadaily.com.cn