Wenzhou's real estate wizards don't jump this time

Investors who profited but got burnt are waiting as the property sector shows signs of life

Business leaders from Wenzhou, Zhejiang province, who are among China's wealthiest and also big-time property investors, appear to be not unduly excited by signs of incipient recovery in the housing sector in January.

According to the National Bureau of Statistics, only 24 out of the 70 medium-sized and large cities surveyed reported month-on-month declines in home prices in January, down from 27 in December.

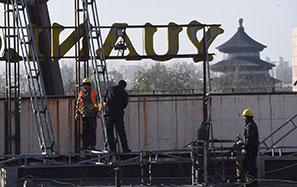

|

Home buyers in Wenzhou check the price board at a real estate fair. Compared with home buyers in other cities, people in Wenzhou seem cautious as prices start to pick up. Provided to China Daily |

Put differently, China's housing market is continuing to grow. Even in the first week of March, new properties in major cities such as Beijing and Shanghai sold out shortly after bookings opened.

In January, new-home prices in more than half of the major cities rose month-on-month. That's a throwback to the days when frenzied buying by Wenzhou investors would trigger a surge in prices, starting in the 2000s.

The recovery in prices started in mid-last year after a long period of cooling, as measures like interest rate cuts and lower down payment requirements boosted new-home sales.

But this time around, the wizards of Wenzhou, having learned some lessons from when the last property bubble burst, are cautious - and wiser, prudent, no different from others. Lazy, if you will, not crazy.

"Wenzhou property investors may not return to the market in a big way any time soon because they are yet to get over their nightmare," says Ding Yi, a developer of luxury homes in Wenzhou.

Gao Lei, who owns a computer company in Wenzhou, says: "There was a time when every household in Wenzhou owned an average of 1.2 properties in Shanghai. Most of my 30 properties have been sold now. I'm not in the game anymore as it has turned too risky with unexpected consequences."

He used to fly to different cities every month with other investors to look for better investment opportunities. Their passion for property started in 2000. Within 10 years, Wenzhou investors, mostly businesspeople, had become famous after, as a group, they started buying apartments across China. In all, they have invested about 200 billion yuan ($30.5 billion; 28 billion euros) in Chinese real estate.

Their purchases led to a surge in prices, which benefited them when they sold but also meant that, by 2010, new homes were beyond the reach of average earners.

That's when the government tightened curbs on the property sector, which was followed by a collapse of the market and a price crash, eventually ending the runaway gains of Wenzhou investors.

"Compared with 2009 and 2010 when prices peaked at around 80,000 yuan per square meter for luxury apartments in Shanghai, the average price now is about 40,000 yuan, which is more reasonable and realistic," Ding says.

Official data show housing prices in Shanghai rose 3.5 percent between February and December last year, the first period of growth since 2011. The average price of new homes dropped nearly 40 percent between January 2012 and January 2015.

Even in Wenzhou, housing prices - and demand - grew a bit. "Here, it's different from other cities," says Jia Wei, a sales manager at a property agency in Wenzhou. "There's no obvious surge in house prices and demand as the locals are no longer keen to make fortunes from speculative investments in property.

"The recovery of the property market in Wenzhou will be slow and stable, and with no bubbles."

yuran@chinadaily.com.cn