Renminbi rate offers no cause for concern

|

|

An employee at a bank counter in Nantong, Jiangsu province, counts renminbi and dollars. [Photo/China Daily] |

THE CHINESE CURRENCY weakened against the US dollar on Monday to a six-year low in the offshore market, with its central parity rate falling to 6.85 against the dollar. Beijing Youth Daily commented on Tuesday:

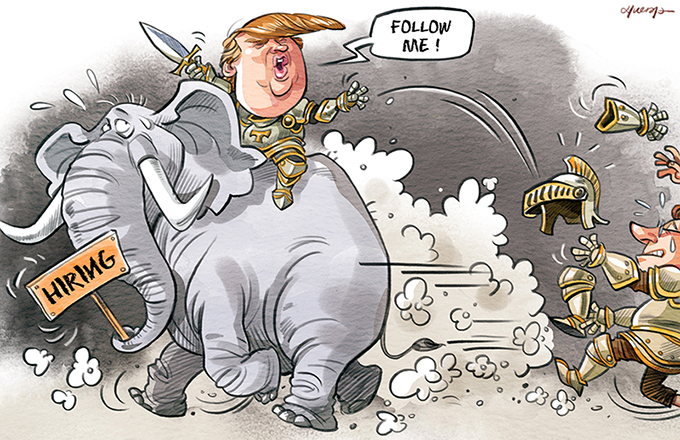

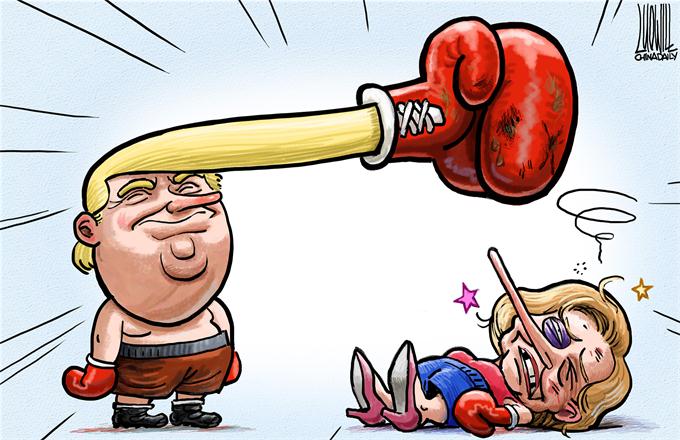

Since Donald Trump defeated his Democratic rival Hillary Clinton in the US presidential election a week ago, the dollar has rallied against several major currencies following upbeat economic data and the possibility of an interest rate hike in the country.

In contrast, the renminbi has weakened. However, the People's Bank of China, the country's central bank, has refrained from intervening and the A-share market has proved to be immune to the plunging renminbi as yet.

Such calmness has a lot to do with the fact that the renminbi remains stable against other major currencies such as the pound sterling and the euro. Its recent depreciation is a natural response to the ever-changing foreign exchange market thus warrants no excessive panic. Besides, there is no basis for persistent yuan depreciation as China is expected to sustain steady economic growth and make progress in economic restructuring to secure a stable financial market.

The Chinese currency's inclusion in the International Monetary Fund's basket of Special Drawing Rights currencies last month adds more weight to the argument that its value is not decided by the dollar.

In fact, the central bank introduced the SDR basket of currencies to evaluate the renminbi and avoid overstatement of its central parity rate against the dollar.

For the country's macroeconomic well-being, depreciating the renminbi is not good news, because it might cause instant turbulence in the financial market and trigger a new round of capital flight.

- B shares fall on weakening renminbi

- Premier: Macao to get renminbi clearing center

- Renminbi usage expands on route

- Chinese currency renminbi will become more important for Australia's economy: ACBC chief

- China gives World Bank go-ahead for first renminbi-settled SDR bond

- Strong US dollar pushes renminbi to a six-year low

- Mild, orderly renminbi depreciation seen

- China opens first renminbi clearing bank in South America