Australia-China economic ties seen as major part of trade, investment

SYDNEY - Trade and investment are two pillars of China-Australia ties, which in turn support the development of an increasingly open economy so that the relationship continues to be mutually beneficial, Australian officials and analysts said.

"China and Australia are located in the most exciting, fast-growing part of the global economy. We work with China and other regional economies to support ongoing growth and development," Australian Trade, Tourism and Investment Minister Steven Ciobo told Xinhua in response to email questions earlier this month.

Mechanisms such as the concept of a Free Trade Area of the Asia-Pacific(FTAAP), an instrument to further the regional economic integration agenda of the Asia-Pacific Economic Cooperation (APEC) free trade forum, can help create a "seamless trading environment and facilitate access for our exporters and suppliers to global value chains," the minister said.

These moves are in line with the goals of the just-concluded APEC summit held in Lima, Peru's capital, with the focus on further promoting free trade and globalization.

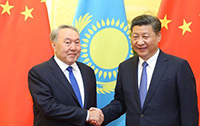

At the forum's 2016 summit, Chinese President Xi Jinping called on the APEC economies to stay committed to taking economic globalization forward, increasing openness in the Asia-Pacific economy, breaking bottlenecks in regional connectivity and blazing new trails in reform and innovation.

On the building of an FTAAP, which was launched at the 2014 APEC meeting in Beijing, Xi hailed the smooth completion of the collective strategic study this year, saying it marked a new phase in FTAAP development.

Economies such as Australia, which are generally more dependent on international trade than larger ones such as the United States, have a real interest in promoting free trade within the Asia-Pacific, said Professor Fariborz Moshirian, director of the Institute of Global Finance at the University of New South Wales in Sydney.

At the same time, China, due to its infrastructure, is still heavily reliant on trade, said Moshirian, whose institute aims to improve global prosperity and stability through collaboration with major international institutions and leading research organizations.

There is a "strong mood" in both Australia and China for more liberalization of trade and investment, particularly trade, said James Laurenceson, deputy director of the Australia-China Relations Institute, a think tank studying bilateral relationship at the University of Technology Sydney.

"There's an incentive for Australia and China to continue to work together in liberalization, bilaterally of course, but we've just had the free trade agreement, so that's a very significant bilateral development; but also for those two countries to push liberalization at bigger levels, at more than a bilateral level, at regional levels," Laurenceson said.

"China and Australia are two countries that very clearly recognize the benefits of freer trade and investment," Laurenceson said.

The China-Australia Free Trade Agreement entered into force in December last year, after a decade of negotiations. The agreement's provisions include many tariff-free Australian exports to China, such as beef, dairy and other agricultural products. More market access to the Australian services sector are also expected to be rolled out.

China is Australia's largest trading partner and Australia is China's seventh-largest trading partner, with two-way trade valued at more than 155 billion Australian dollars (119 billion U.S. dollars) last year, according to the Australian Trade and Investment Commission.

China is also Australia's largest source of international students, most valuable tourism market, a major source of foreign direct investment and its largest agricultural goods market, according to the commission.

But there are still global obstacles to efforts at opening up more trade and investment, Moshirian said, adding one of those obstacles is protectionism.

"Forecasts from the International Monetary Fund and others are that the global economy is not going to grow rapidly and I think part of that is countries are following protectionism, but also because of this fear of slow economic growth, they're trying not to promote free trade, which in itself will have another negative effect on trade," he said.

"They're trying to increase their exports and reduce their imports, but if everyone does it, it's the same thing that happened during the Great Depression, and you suddenly slow down free trade," he noted.

An "ideal situation" to combat that would be the multilateral free trade push under the Doha round of trade negotiations, done at the global level, Moshirian said. But differences between the countries involved in the talks form one of the reasons why such efforts are hampered.

In that respect, what China has done in terms of feasibility studies for free trade and its attempts to be more inclusive should be welcomed, he said.

It certainly makes sense for Australia and China to support free trade and investment agreements, Laurenceson said.

"This is a bilateral relationship that has been overwhelmingly good for both countries ...in terms of economics, I just don't think you could find two more complementary economies," he said.

"Let's not forget that every time Australia and China trades, or invests in each other, they do it because it's mutually beneficial. You don't trade because one person wins, and one person loses. That's the beauty of economics; whether its trade or investment, it's a positive sum game," he said.

"So Australia and China have a long history of celebrating this positive sum game, and I think that's going to continue," he added.