BEIJING - China's new yuan-denominated lending in June stood at 860.5 billion yuan ($139.62 billion), up from 667.4 billion yuan in May, the central bank said Friday.

The June figure was down 59.3 billion yuan from the same period of last year, the People's Bank of China said in a statement on its website.

In the first half of 2013, new yuan-denominated loans reached 5.08 trillion yuan, 221.7 billion yuan higher than a year ago, according to the statement.

Last month, Chinese lenders were hit by a severe liquidity crunch, as indicated by a surge in the Shanghai Interbank Offered Rate overnight rate, a basic gauge of interbank borrowing costs, to a historic high of 13.44 percent on June 20.

Three days later, the central bank vowed to enhance liquidity management and keep a stable and moderate growth in its credit supply and social financing.

It said the country would continue to implement a prudent monetary policy and fine-tune it at a proper time.

Guo Tianyong, a professor at the Central University of Finance and Economics, said the lending figure for June was at a reasonable level after the central bank's controlling efforts.

Commercial banks should not only maintain a moderate credit level, but also ensure the quality of lending by channeling more funds to the real economy, instead of seeking profits only inside the financial sector, Guo said.

The State Council, the country's cabinet, said last month that the country should firmly guard against systemic risks and make sure that credit is channeled into real economy.

Guo predicted that the monthly new loans in yuan will stay around 700 to 800 billion yuan in the next few months.

M2, a broad measure of money supply that covers cash in circulation and all deposits, increased 14 percent year on year to 105.45 trillion yuan at the end of June.

The growth rate was down 1.8 percentage points from the May level, the PBOC said.

The narrow measure of money supply (M1), which covers cash in circulation plus demand deposits, expanded 9.1 percent at the end of last month, dropping 2.2 percentage points from a month earlier.

"The growth rate of M2 is moving toward the 13-percent target set by the government, showing the central bank's intention of liquidity management," said Zhong Zhengsheng, an analyst.

E Yongjian, a financial analyst with the Bank of Communications, said the country's monetary policy will have to seek a balance between the targets of stabilizing growth and preventing financial risks in the latter half of 2013.

Models at Ford pavilion at Chengdu Motor Show

Models at Ford pavilion at Chengdu Motor Show

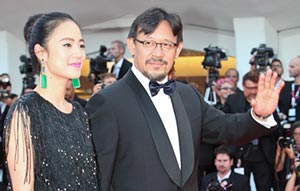

Brilliant future expected for Chinese cinema: interview

Brilliant future expected for Chinese cinema: interview

Chang'an launches Eado XT at Chengdu Motor Show

Chang'an launches Eado XT at Chengdu Motor Show

Hainan Airlines makes maiden flight to Chicago

Hainan Airlines makes maiden flight to Chicago

Highlights of 2013 Chengdu Motor Show

Highlights of 2013 Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

'Jurassic Park 3D' remains atop Chinese box office

'Jurassic Park 3D' remains atop Chinese box office

Beauty reveals secrets of fashion consultant

Beauty reveals secrets of fashion consultant