The Chinese dream of rejuvenating and re-energizing the Chinese nation, which President Xi Jinping has positioned as a rallying cry for the further development of a harmonious China, needs to be accessible to most, if not all, Chinese citizens.

At the 18th National Congress of the Communist Party of China, Chinese leaders firmly set a goal to double the country's GDP, and per capita income of urban and rural residents by 2020 to establish a moderately prosperous society in all respects. But given the well-documented income gap between rural and urban areas, the absolute difference in incomes would surely widen in this process. It is hard to eliminate this relative poverty, though it must be conceded that living costs are lower in rural areas.

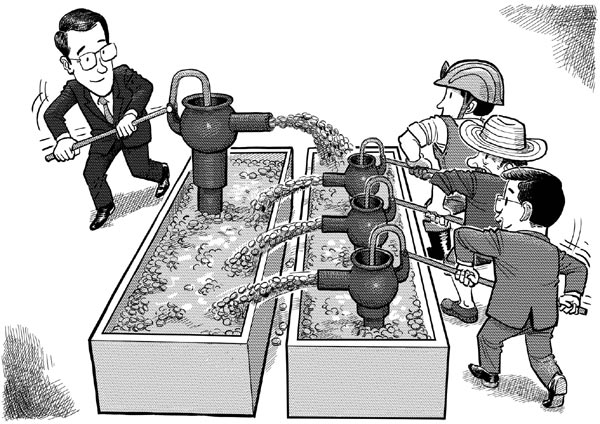

Nevertheless, a positive step toward income redistribution is needed to lessen the urban-rural divide as urbanization gains pace.

What seems likely is that continued urbanization will create a growing middle class, which may reach 600 million by the end of this decade. The current application of the personal income tax system, with a monthly threshold of 3,500 yuan ($571.85) before income becomes liable to tax, means that more than 80 percent of Chinese citizens do not pay income tax.

This threshold will surely be raised in the future and the average rural resident may still pay no income tax even in 2020. In first-tier cities, many would argue that living on 5,000 yuan to 7,000 yuan a month is very challenging and would like a higher threshold even today. Yet as China's middle class grows, it is unrealistic for such a large group of the population not to contribute in a meaningful way to income-tax revenue.

There are significant differences in per capita GDP in different regions of China. Data from the National Bureau of Statistics show that in 2011, per capita GDP of Beijing, Guangzhou and Shanghai, Jiangsu, Jilin and Zhejiang provinces, and the Inner Mongolia autonomous region was more than 50,000 yuan a year, whereas that of Gansu, Guizhou and Yunnan provinces, and the Tibet autonomous region was less than half of that. Yet as in most countries, income tax is a national system that does not take into account these differences.

Direct taxation of income is a key method of redistributing income where there is significant inequality in the distribution of income pre-tax. Among the major economies, China is one of the most unequal societies in terms of income distribution. The extent of income inequality is measured by Gini index, named after Italian statistician Corrado Gini. The closer this index is to zero, the more equal is the distribution, with anything exceeding 0.4 considered worrying.

2013 Beijing Intl Jewelry Expo kicks off

2013 Beijing Intl Jewelry Expo kicks off

Microsoft revamps Surface to challenge Apple

Microsoft revamps Surface to challenge Apple

Highlights of AOPA-China Fly-In air show

Highlights of AOPA-China Fly-In air show

Car Free Day to fight air pollution

Car Free Day to fight air pollution

Liaoning carrier completes its furthest sea trial

Liaoning carrier completes its furthest sea trial

798 Art Festival kicks off in Beijing

798 Art Festival kicks off in Beijing

Intl comic festival 'Comicopolis' held in Buenos Aires

Intl comic festival 'Comicopolis' held in Buenos Aires

Highlights of CIAPE 2013

Highlights of CIAPE 2013